I like to trade broker-wing butterflies (BWB) because if it is positioned well, it can be quite a delta-neutral and positive theta trade. There are many underlyings you can trade BWBs on, but I particularly like SPX, SPY, and some other big tech names with higher stock prices.

In this article, I would like to show you how to scan and get notified for flat, delta-neutral SPX BWBs using the scanner.

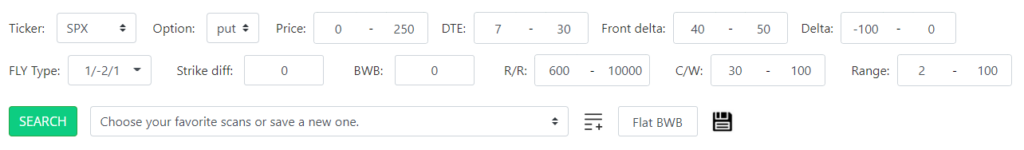

Let’s discuss each field and why they are set the way I did.

Ticker: “SPX”, but it can also be a list of tickers, including SPY or any other stocks.

Option: “put” means I am looking only for put butterflies because I want to benefit from a higher-than-usual IV and we know that when IV is high, put butterflies get cheaper.

Price: “0 – 250”, I am looking for butterflies in the price range of 0-250 dollars.

DTE: “7 – 30”, looking for spreads with 7-30 days to expiration.

Front delta: “40 – 50” defines the delta of the front leg of the butterfly spread. Using this setting, the result will only show me butterflies where the front leg is around ATM.

Delta: “-100 – 0” is the net delta of the position. I am configuring it to have a negative net delta which means the butterfly is either delta-neutral or directionally short (negative net delta).

FLY type: there are 3 types of butterfly configurations to choose from 1/-2/1, 1/-3/2, and 2/-3/1. For this specific setup, I am using 1/-2/1.

Strike diff: “0”, this is a “joker” character, which means if I specify 0 as a strike difference, it will scan for all the possible combinations that meet my criteria. Since I don’t want to stick with any strike differences, I need to use 0 to see all.

BWB: “0”, this is also set to 0 because I don’t want to specify the broken wing part’s strike difference. Using 0, I will see all the combinations it can show me.

R/R: “600 – 10000” means I am looking for spreads that have a reward-to-risk ratio of at least 600%. In a BWB configuration, this means that the theoretical max profit of the spread is 600% compared to the max loss on the broken wing side.

C/W: “30 – 100” stands for the percentage of credit/width I get for shorting the extra embedded vertical that is found on the broken wing side. The higher it is, the more credit I need to receive. For this configuration, I set it to have a minimum of 30% which means that I get at least 30% credit compared to the short put spread’s width. What this does is limit how far OTM can be the short vertical spread.

Range: “2 – 100” defines how wide the breakeven range in percentage should be in the butterfly spread. For this setup, I need it to have at least 2% which means there is a 2% price move difference between the breakeven points of the butterfly.

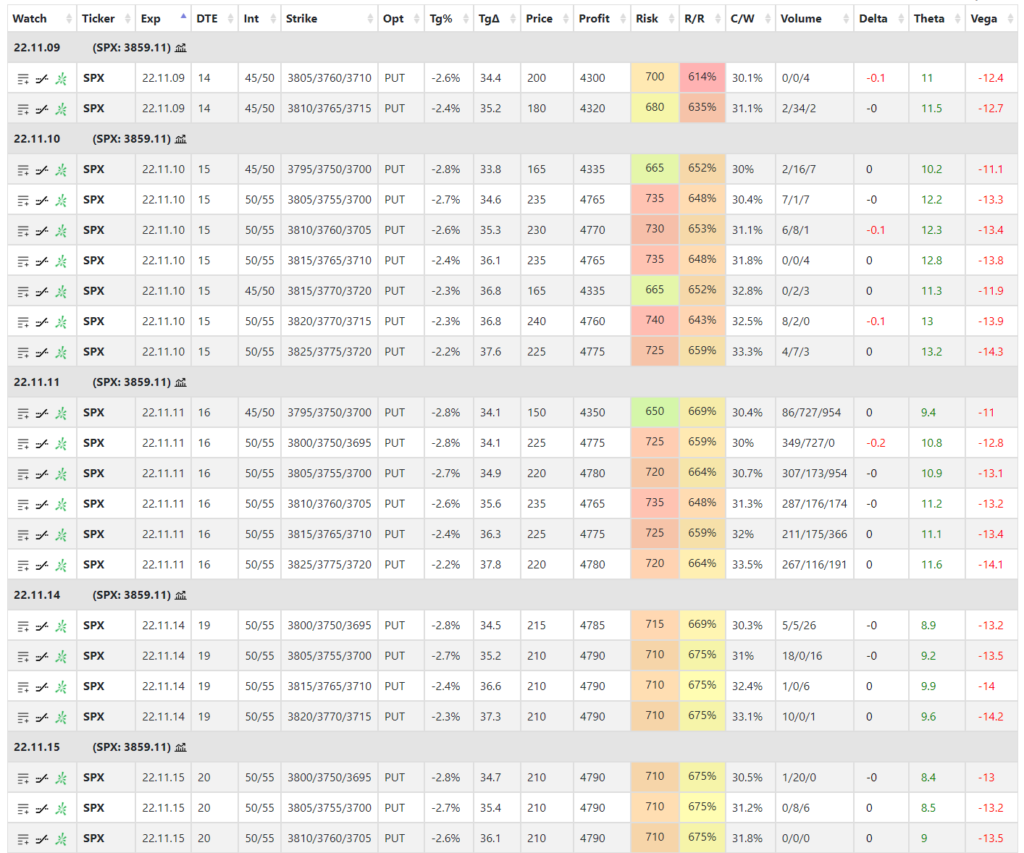

After running the scanner, here are the results. It contains more than I could create a screenshot of because there are many variations using the 0 as strike differences.

As you can see there are different versions of this butterfly in terms of DTE, strike differences, etc.

Let’s go through what the columns mean.

Exp: the expiration of the butterfly.

Int: the strike intervals (differences) between the legs. As you can see most of the spreads have somewhere around 40/45 and 50/55 strike intervals.

Strike: the exact butterfly strikes. I usually try to center my butterflies around some support level in this case. So looking at the middle strikes you immediately see where the butterfly will max out at expiration.

Opt: option is either call or put, depending on your market direction. Right now, I am using put.

Tg%: target %, how far the strike is in percentage move from the current stock price. In this case, how much the market has to fall to reach the middle strike of the butterfly.

TgΔ: the target delta of the spread which is the middle strike’s delta in this case.

Price: the price of the butterfly.

Profit: the theoretical max. profit you can make on the spread.

Risk: the max risk of the trade, in this case, the broken wing part.

R/R: reward to risk in percentage.

C/W: credit/width of the embedded short vertical. In this case, be it over 30%.

Volume: each leg’s daily volume.

Range: what is the price range in percentage between the breakeven points of the spread (how wide it is).

Delta: net delta of the spread. Remember I set it to be negative.

Theta: net theta of the spread. They are all positive theta spreads.

Vega: net vega of the spread.

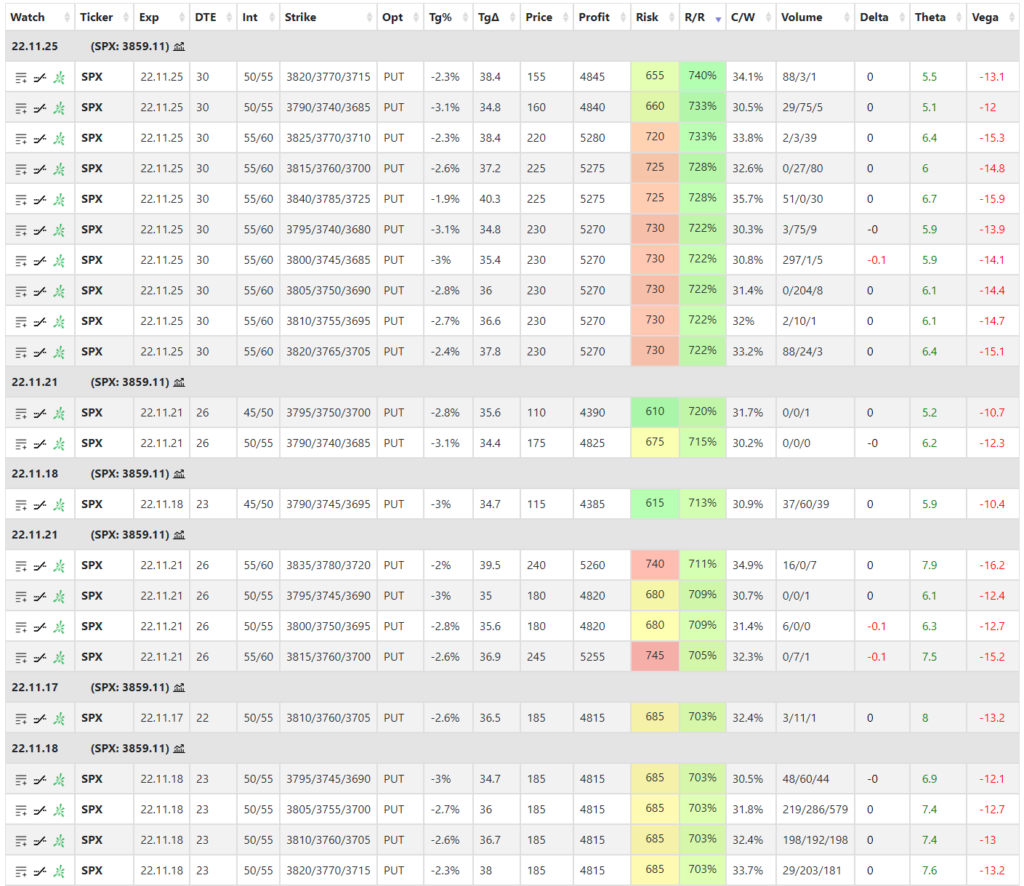

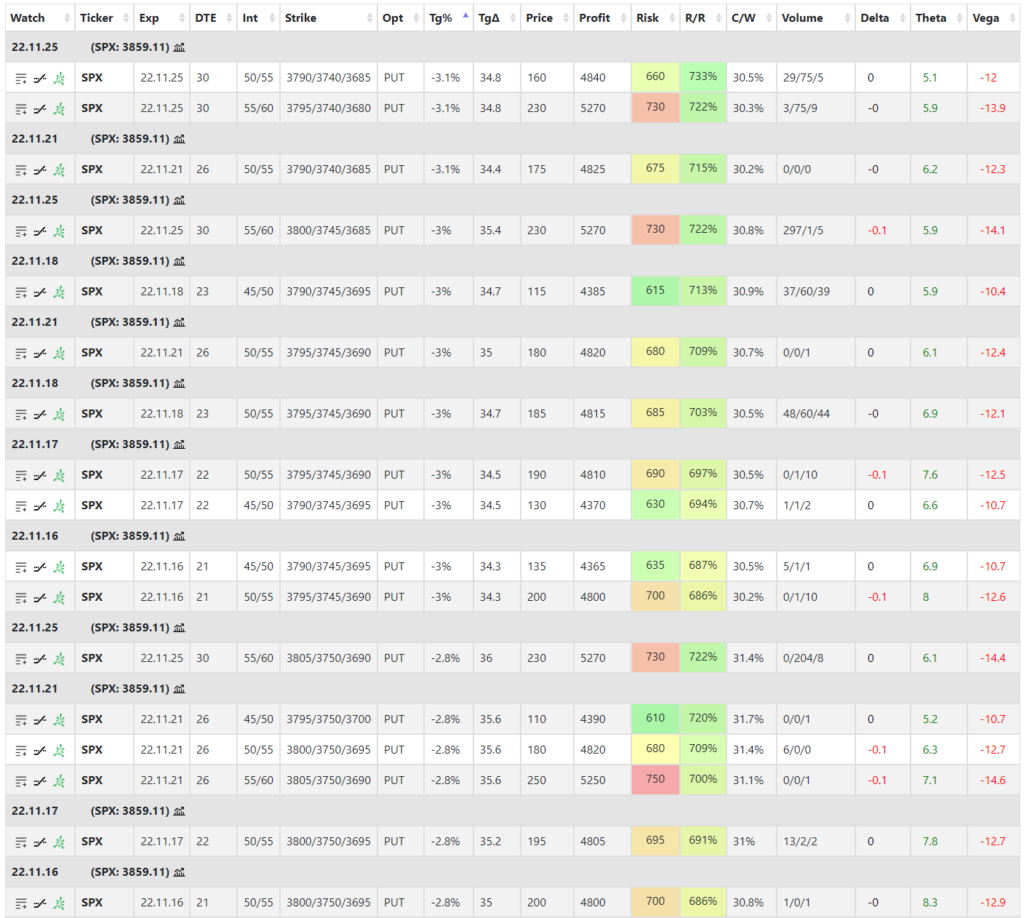

If I sort the table by R/R, I get this result.

So the highest R/R is in the furthest expiration with 30 DTE. That is pretty obvious because the position will have more time to go wrong. Also, it has the lowest daily theta. So the trader has to decide which one is more important for his trade, being optimized for R/R, delta, theta, etc.

Let’s sort the table by Tg% to see which spread is furthest from the money with acceptable price and parameters.

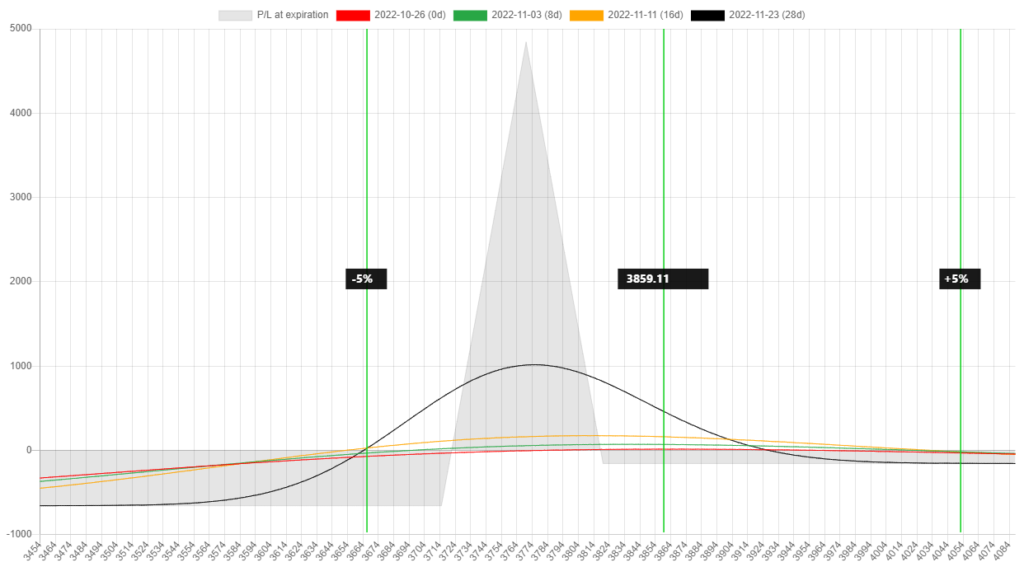

So the furthest middle strike is 3740, which is -3.1% away from the current market price. And this is also the cheapest and highest R/R but with 30 days to go. Let’s check its risk graph by clicking on the icon.

Let’s get notified

If I am looking for very cheap ones that are not available right now, for example, $150, I can set the scanner to alert me whenever it finds it in the market.

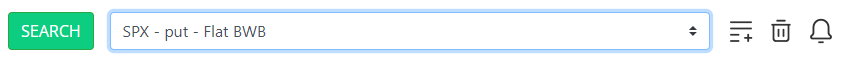

I can save this scan as a favorite and later on reuse it or enable an alert and get notified whenever there is a new one found in the market.

If you click on ![]() icon you can name this scan:

icon you can name this scan:

I have named it “Flat BWB”. After saving it, you can select it from the dropdown list and if you click on the ![]() icon an alert is enabled for this scan. It means that the scanner will search the market every 5 minutes to look for spreads that meet these criteria.

icon an alert is enabled for this scan. It means that the scanner will search the market every 5 minutes to look for spreads that meet these criteria.

If anything is found, you get an email about it. Don’t worry we will not spam you with the same spreads every 5 minutes. After a spread is found and sent via email, only new ones will be sent afterward.

Butterfly scanner guide

For a more detailed explanation of how to use this spread scanner please watch the following video.

Follow for more ideas

If you are interested in more ways how to harness the power of the scanner, please subscribe below.