Options trading FAQ

What is options trading about Options trading is the practice of buying and selling options contracts. Options contracts are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset, such as a stock, commodity, or currency, at a specific price (strike price) within a certain period […]

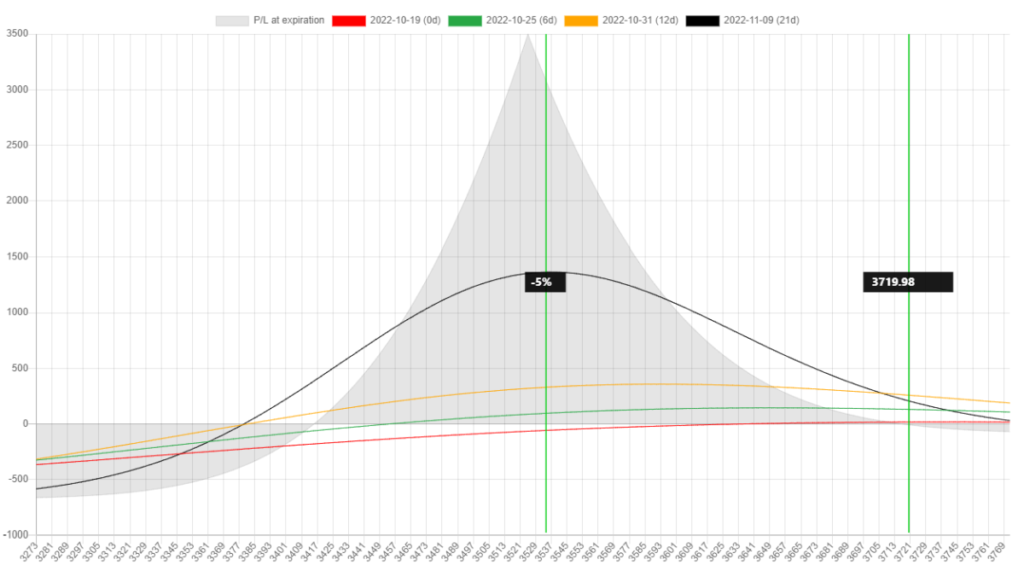

Flat SPX Put BWB

I like to trade broker-wing butterflies (BWB) because if it is positioned well, it can be quite a delta-neutral and positive theta trade. There are many underlyings you can trade BWBs on, but I particularly like SPX, SPY, and some other big tech names with higher stock prices. In this article, I would like to […]

SPX 0 DTE Butterflies

0 DTE stands for strategies that expire on the day of opening them, hence there is 0 day to expiration. The most popular underlying for these strategies are SPY and SPX. I like SPX better because more strikes are available to build the strategy. In this article, I would like to show you how I […]

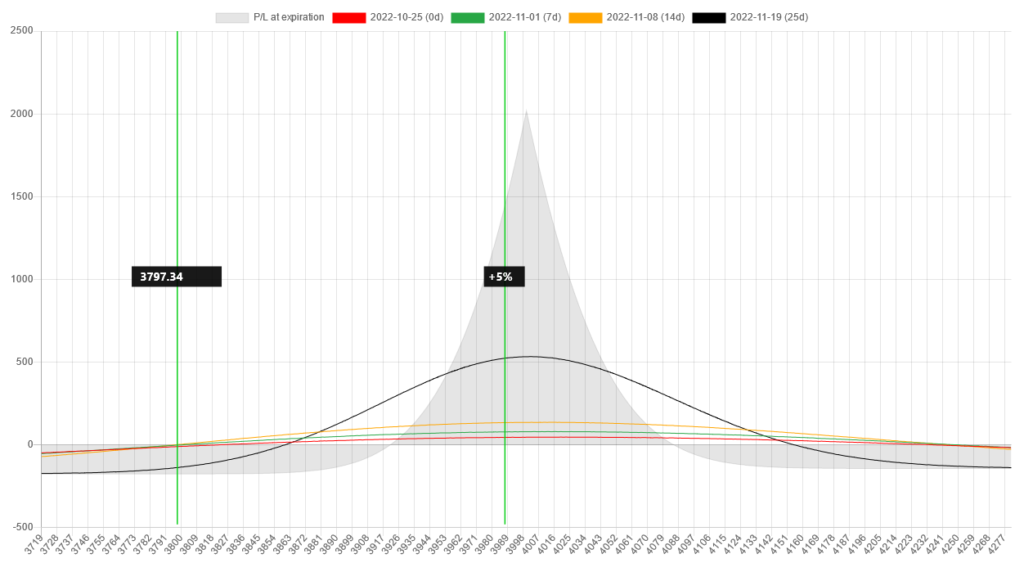

Cheap SPX call calendars

In this article, I would like to show you how to scan (and be alerted) for cheap SPX calendar spreads. Let’s assume, that I am looking for a call calendar spread because I think that SPX will rise in the next 2-3 weeks. Right now SPX has option expirations every single day. So sometimes there […]

Top features of NinjaSpread

There are two main goals of the scanner: show you hidden opportunities and save a lot of time with automated scanning. Let’s see what the top features are and how NinjaSpread can help your trading life. Find the best spread combinations No matter if you are looking for spreads in a single ticker or a […]

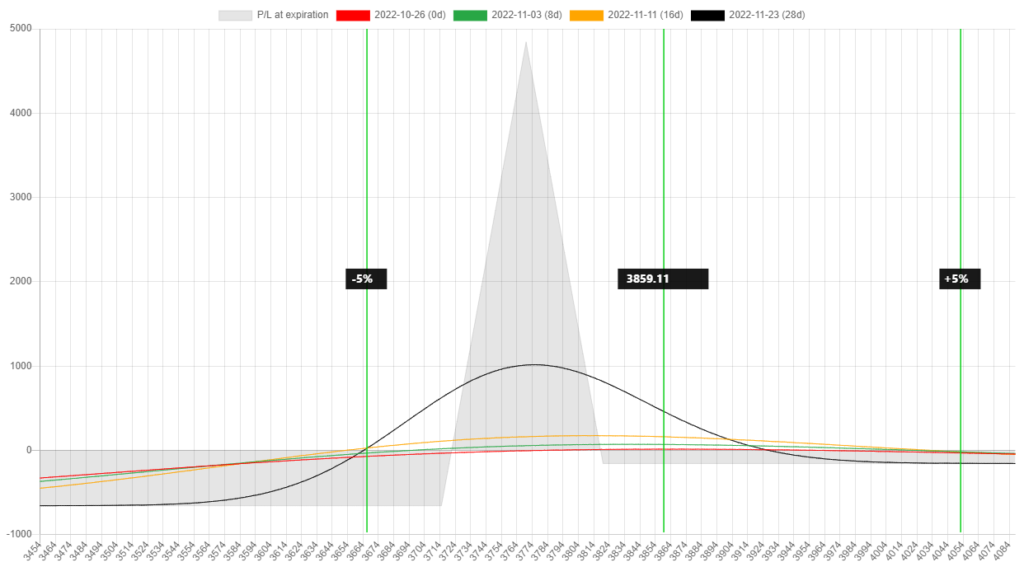

Wide, flat SPX diagonal spread

I love to trade SPX diagonals, especially when IV skew is higher than usual and I get a wider range of break evens. I know that time spread break evens are “theoretical” because they are dependent on the IV skew of the front and back month’s IV that changes all the time. I always wanted […]

Calendar spread for earnings

There are several option strategies for earnings season. One of the most widely used is the calendar spread. This is because you can harness the IV skew between expirations using a calendar spread. What is an IV skew? Approaching earnings, the IV of the front month always increases more than the back month. This is […]