Introducing Our Latest Features

NinjaSpread, renowned for its powerful and user-friendly tools for options spread scanning, is excited to introduce its latest feature set. This update is designed to provide a more comprehensive and tailored experience for traders and investors, offering a new level of customization and precision in managing options spreads.

With the new features, users can now search for butterfly spreads by specifying the range of each leg’s delta. This unique feature allows for a more sophisticated scanning method, enabling traders to pinpoint their search according to their specific risk tolerance and market expectation.

A butterfly spread is an advanced options strategy that involves a combination of bullish and bearish spreads, with differing strike prices but the same expiration date. By specifying the range of each leg’s delta, NinjaSpread users can tailor the strategy to their specific needs, optimizing potential profits while managing risk.

The new feature set also includes the option to set a minimum reward-to-risk ratio. This vital tool is for traders striving to optimize their potential returns relative to the risks involved. By setting a minimum reward-to-risk ratio, traders can ensure they’re adequately compensated for the risks they’re taking, leading to more balanced and profitable trading strategies.

Now, if you’re seeking a delta-neutral position, NinjaSpread has you covered with another novel feature: the ability to define the net delta range of the position. This added functionality provides traders with the flexibility to search specifically for delta-neutral positions, allowing them to maintain a balanced portfolio and hedge against market volatility.

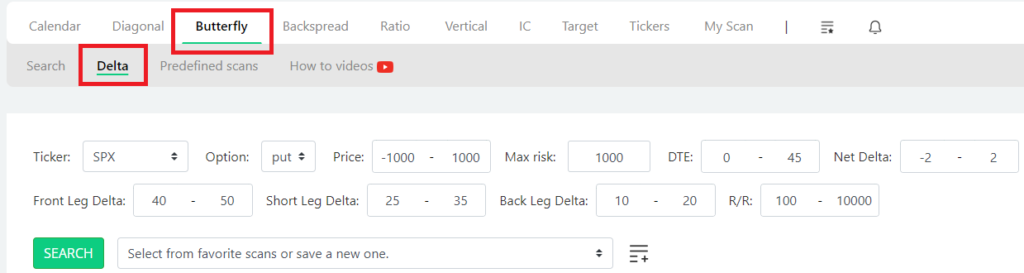

How to Use the New Scanner

Now, let’s dive into how to use this part of the scanner. We’ll discuss each field and why they’re set the way they are.

Let’s discuss each field and why they are set the way I did.

Ticker: “SPX”, but it can also be a list of tickers, including SPY or any other stocks.

Option: “put” means I am looking only for put butterflies because for example I want to benefit from a higher-than-usual IV and we know that when IV is high, put butterflies get cheaper.

Price: “-1000 – 1000”, I am looking for butterflies in the price range of -1000 to 1000 dollars. Minus means I am also interested in credit butterflies.

Max: “1000”, I am looking for butterflies that has a maximum risk of 1000 dollars.

DTE: “0 – 45”, looking for spreads with 0 – 45 days to expiration.

Net Delta: “-2 – 2” defines the net delta of the position. Specifying -2 to 2 means it should be a farely delta neutral butterfly.

Front Leg Delta: “40 –50” the front (long) leg of the butterfly’s delta range. So the structure starts around ATM delta.

Short Leg Delta: “25 – 35” the delta range of the short (middle) strikes in the butterfly.

Back Leg Delta: “10 – 20” the further long leg’s delta range of strikes.

R/R: “100 – 10.000” means I am looking for spreads that have a reward-to-risk ratio of at least 100%. This means that the theoretical max profit of the spread is 100% compared to the max loss of the butterfly.

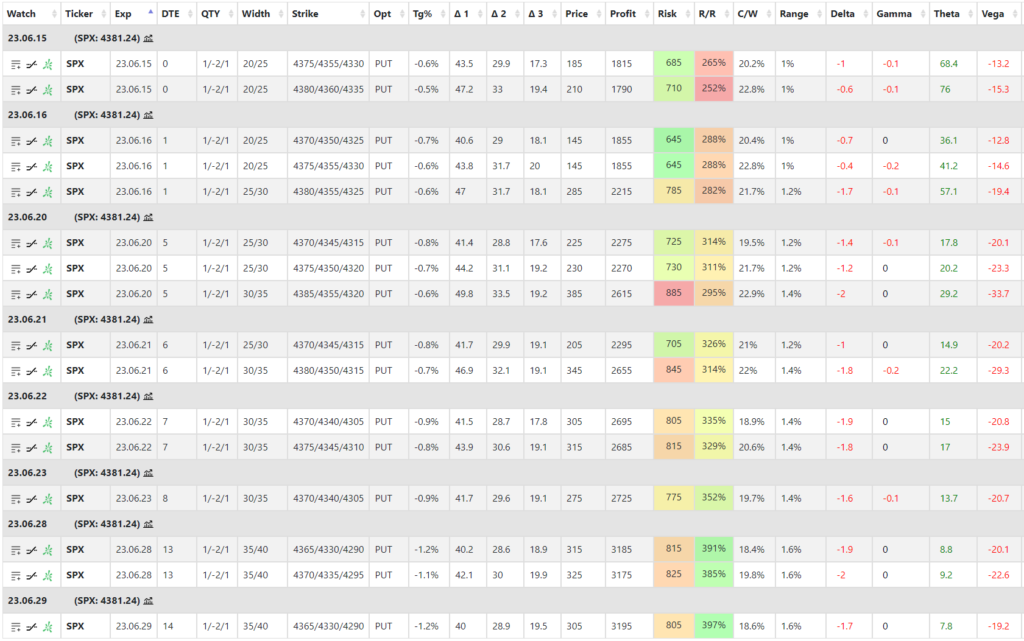

Understanding the Results

After running the scanner, here are the results. Click on the image to enlarge it. Let’s go through what each column means.

As you can see there are different versions of this butterfly in terms of DTE, strike differences, etc.

Exp: the expiration of the butterfly.

Width: the strike widths between the legs. As you can see most of the spreads have somewhere around 30-50 strike widths.

Strike: the exact butterfly strikes. I usually try to center my butterflies around some support level in this case. So looking at the middle strikes you immediately see where the butterfly will max out at expiration.

Opt: option is either call or put, depending on your market direction. Right now, I am using put.

Tg%: target %, how far the strike is in percentage move from the current stock price. In this case, how much the market has to fall to reach the middle strike of the butterfly.

Δ 1: the front leg’s delta of the spread.

Δ 2: the short leg’s delta of the spread.

Δ 3: the back leg’s delta of the spread.

Price: the price of the butterfly.

Profit: the theoretical max. profit you can make on the spread.

Risk: the max risk of the trade.

R/R: reward to risk in percentage.

C/W: credit/width of the embedded short vertical. The higher the number, the more you get for shorting the credit spread part of the butterfly.

Range: what is the price range in percentage between the breakeven points of the spread (how wide it is).

Delta: net delta of the spread.

Gamma: net gamma of the spread.

Theta: net theta of the spread.

Vega: net vega of the spread.

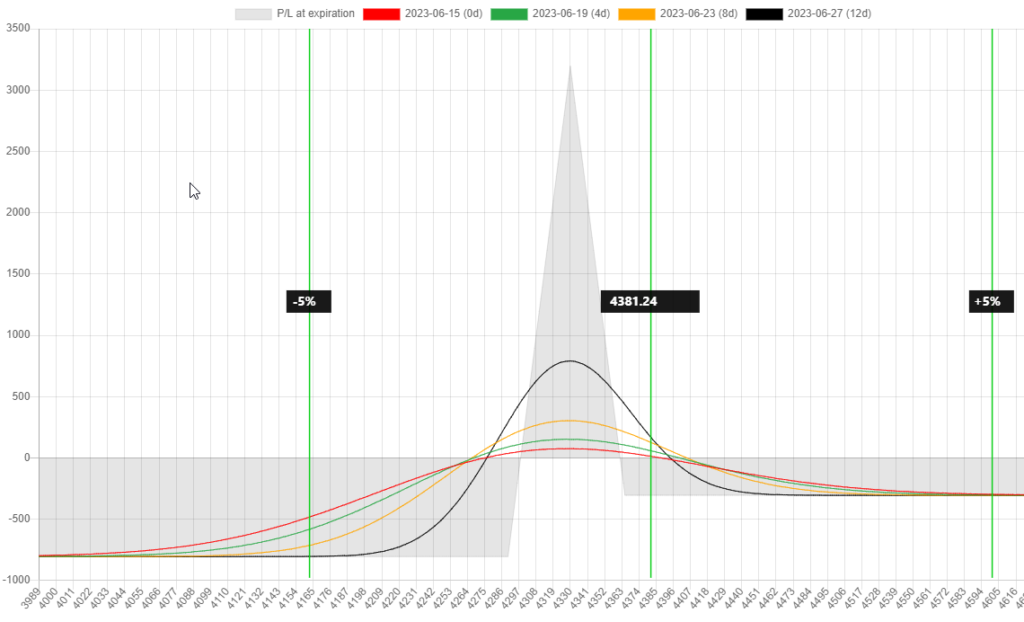

Examining the Risk Graph

You can further analyze any of the butterflies using the built-in risk graph. Let’s check on a risk graph by clicking on the icon.

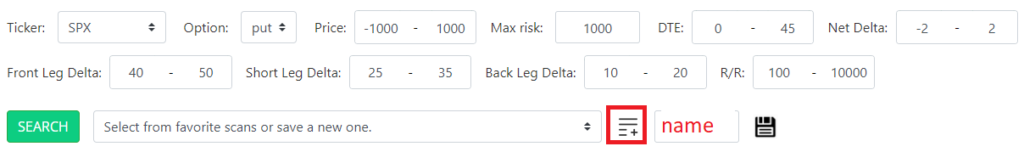

Stay Informed with Notifications

With NinjaSpread, you can save this scan as a favorite and later on reuse it or enable an alert and get notified whenever there is a new one found in the market.

If you click on ![]() icon you can name this scan:

icon you can name this scan:

After saving it, you can select it from the dropdown list and if you click on the ![]() icon an alert is enabled for this scan. It means that the scanner will search the market every 5 minutes to look for spreads that meet these criteria.

icon an alert is enabled for this scan. It means that the scanner will search the market every 5 minutes to look for spreads that meet these criteria.

If anything is found, you get an email about it. Don’t worry we will not spam you with the same spreads every 5 minutes. After a spread is found and sent via email, only new ones will be sent afterward.

Join Us for More

These new features underscore NinjaSpread’s commitment to providing innovative and user-friendly tools for options spread scanning. By giving traders the ability to tailor their strategies according to their risk tolerance and market expectations, NinjaSpread continues to lead the way in delivering cutting-edge solutions for options trading.

The update is now live, and we encourage all traders, whether seasoned or new, to explore these features and see how they can enhance their trading experience. With NinjaSpread, the power to manage your options spreads is literally at your fingertips.

Stay tuned for more exciting updates from NinjaSpread as we continue to enhance our platform to better serve the needs of our trading community.

Follow for more ideas

Want to learn more about how to harness the power of the scanner? Subscribe below to stay up-to-date with our latest tips and ideas!