Margin requirements

A margin account is a type of investment account that allows an investor to borrow money from the brokerage firm to purchase securities. This additional buying power is known as

A margin account is a type of investment account that allows an investor to borrow money from the brokerage firm to purchase securities. This additional buying power is known as

Options trading can be a powerful tool for making money with volatility skew. Volatility skew refers to the difference in implied volatility between options with different strike prices or expiration

Volatility skew refers to the difference in implied volatility between different strike prices of options contracts for the same underlying asset. This difference in volatility can take on various forms,

Options trading can be a powerful tool for investors and traders looking to enhance returns, generate income, or hedge against potential losses in other investments. However, options trading is also

What is options trading about Options trading is the practice of buying and selling options contracts. Options contracts are financial derivatives that give the holder the right, but not the

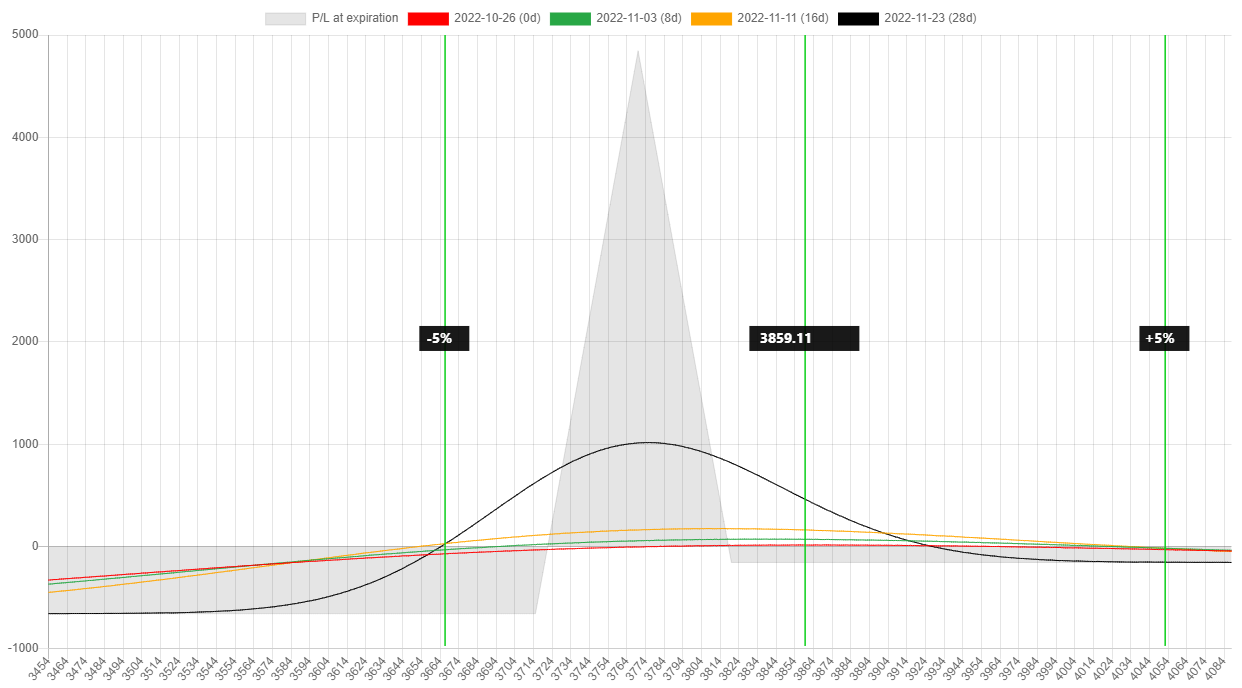

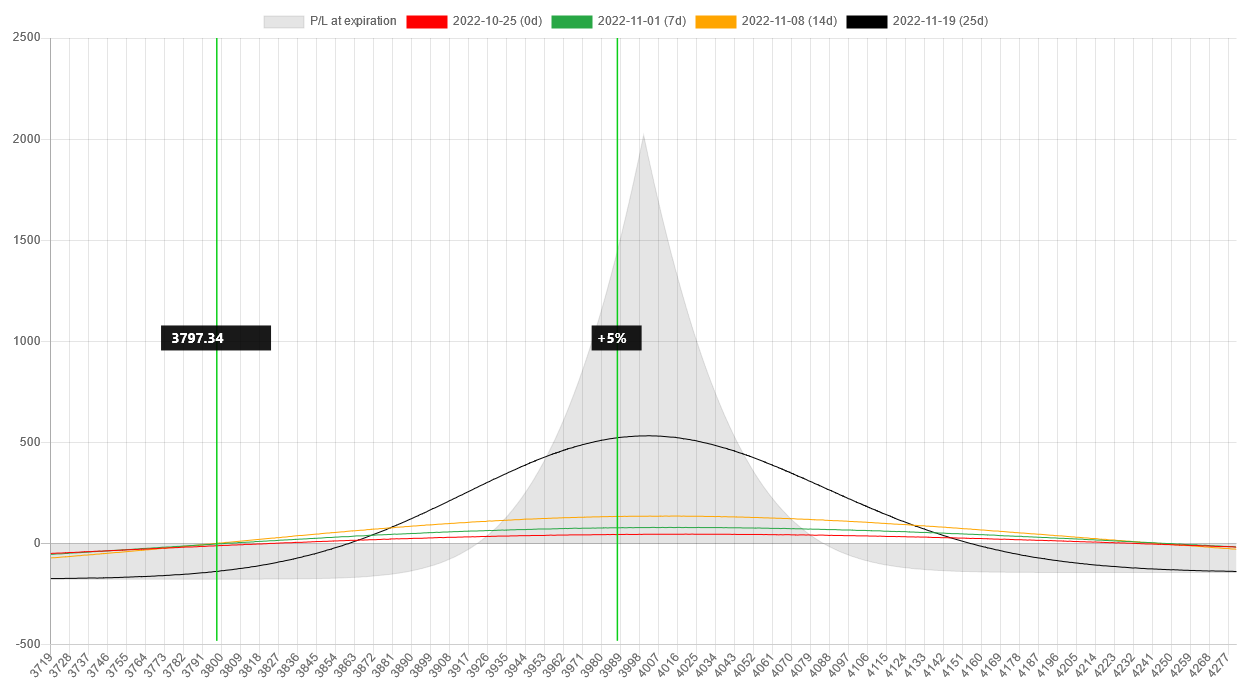

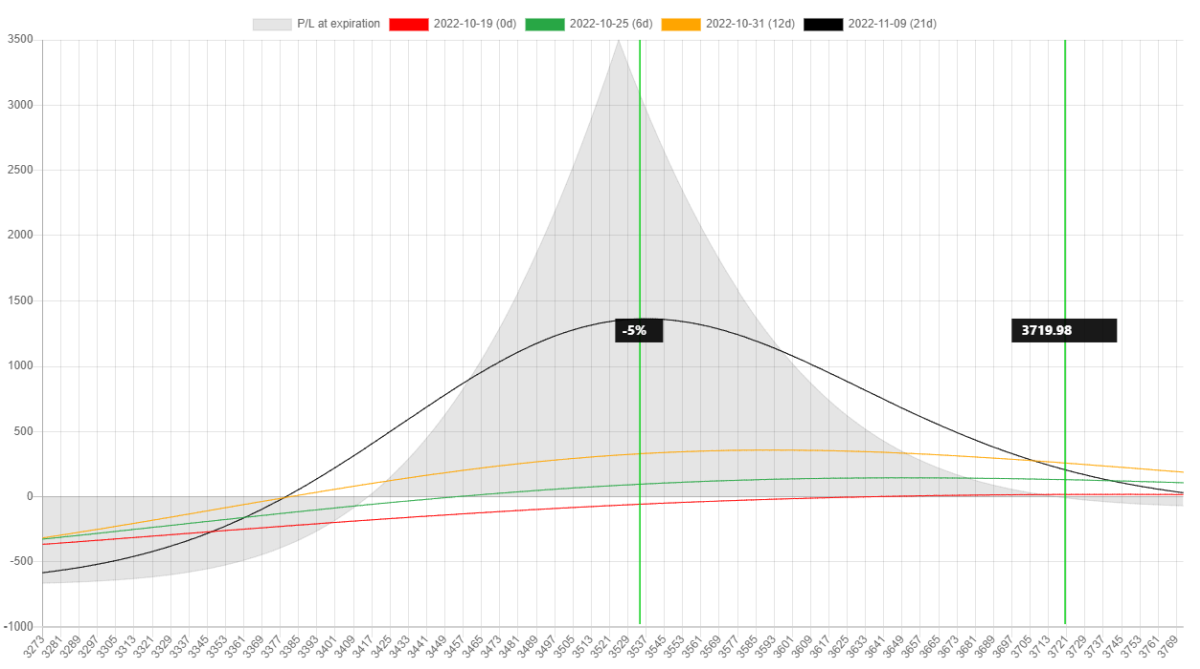

I like to trade broker-wing butterflies (BWB) because if it is positioned well, it can be quite a delta-neutral and positive theta trade. There are many underlyings you can trade

0 DTE stands for strategies that expire on the day of opening them, hence there is 0 day to expiration. The most popular underlying for these strategies are SPY and

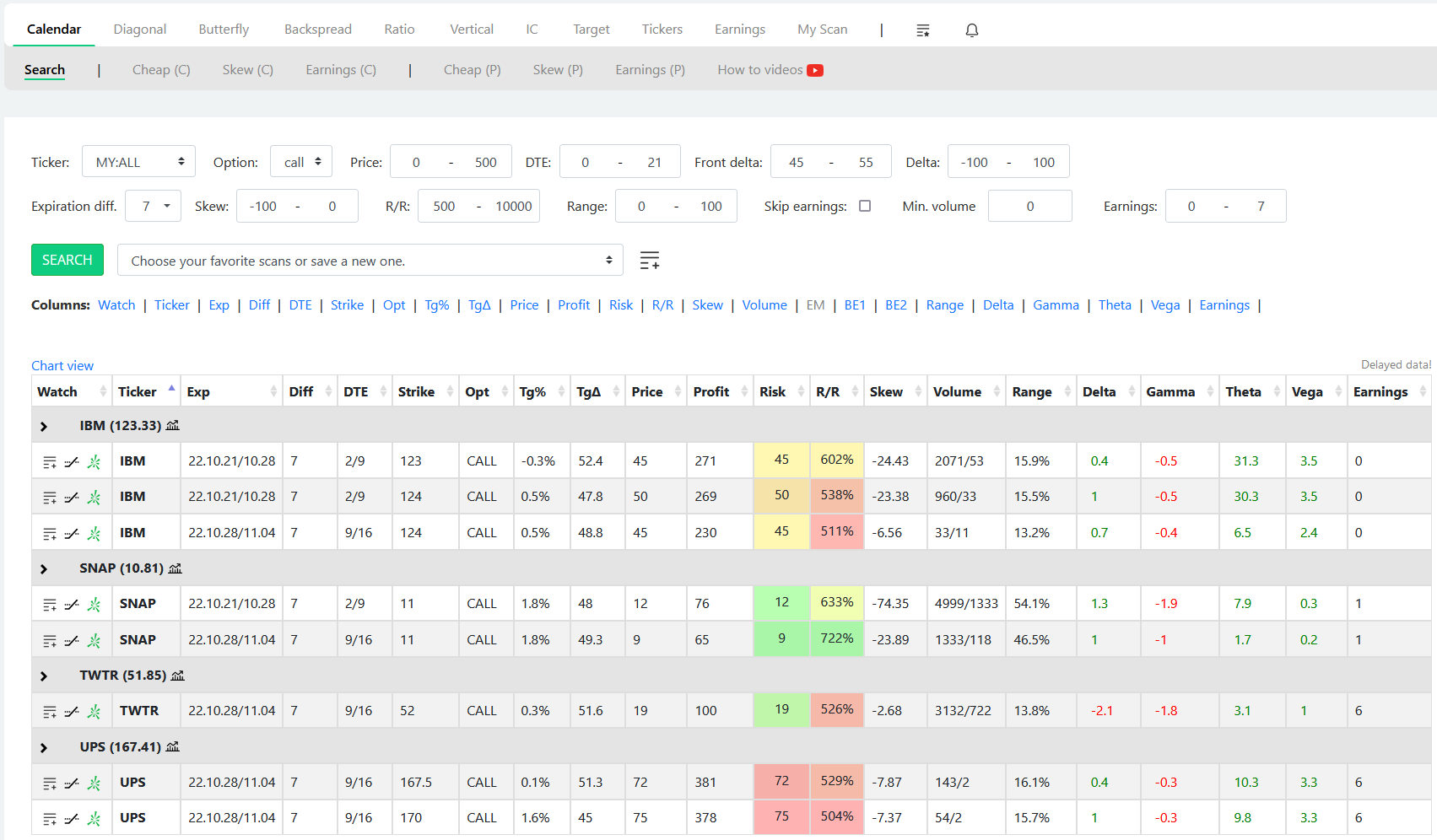

In this article, I would like to show you how to scan (and be alerted) for cheap SPX calendar spreads. Let’s assume, that I am looking for a call calendar

There are two main goals of the scanner: show you hidden opportunities and save a lot of time with automated scanning. Let’s see what the top features are and how

I love to trade SPX diagonals, especially when IV skew is higher than usual and I get a wider range of break evens. I know that time spread break evens

There are several option strategies for earnings season. One of the most widely used is the calendar spread. This is because you can harness the IV skew between expirations using